Managing online payments is essential for businesses aiming to streamline transactions, enhance customer tracking, and automate financial processes. By integrating Stripe with SpreadsheetWeb, companies can create a workflow that enables direct product purchases, transaction tracking, and customer management—all without requiring backend development. This approach simplifies payment processing while ensuring accuracy and scalability.

This article provides a step-by-step guide on setting up Stripe products, generating payment links, and integrating with SpreadsheetWeb. Additionally, it explores different payment integration methods, including Stripe Checkout Sessions and Custom Payment Gateways, with detailed explanations and side-by-side comparisons to help businesses choose the best solution for their needs.

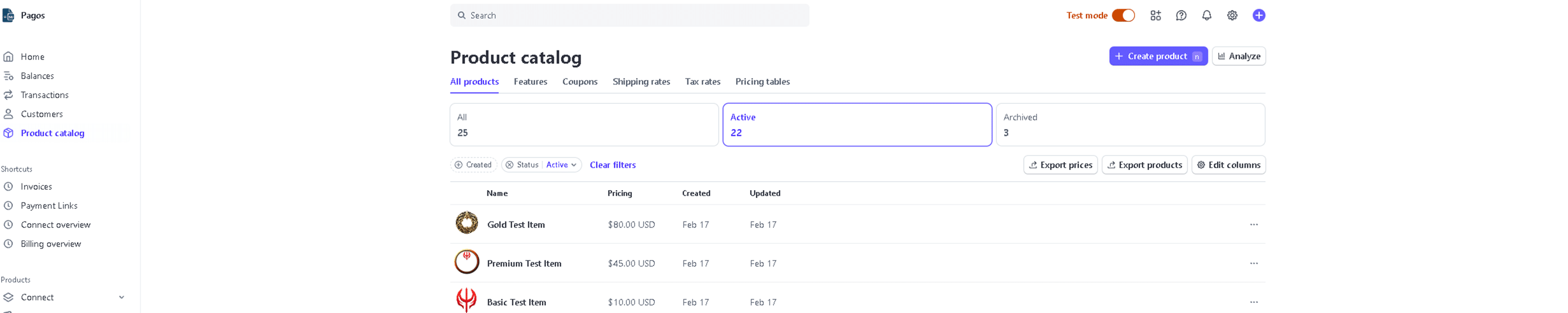

Step 1: Creating Products in Stripe

Before setting up payments, products must first be created in Stripe. Follow these steps to create one-time purchase products:

- Log in to your Stripe Dashboard.

- Navigate to Products in the left panel.

- Click on + Add Product.

- Enter the product details:

- Name: (e.g., Basic Product, Premium Product, Gold Product)

- Description: Provide a short description of the product.

- Price: Set a fixed one-time price.

- Currency: Choose your preferred currency.

- Click Save Product.

Repeat this process for each product you wish to offer.

Step 2: Generating Stripe Payment Links

Once the products are created, generate payment links to allow users to make purchases directly without needing backend processing.

- Go to the Stripe Dashboard and navigate to Products.

- Select the product for which you want to create a payment link.

- Click on Create Payment Link.

- Customize the checkout experience if needed.

- Copy the generated payment link.

Do this for all products and store the links for later use in SpreadsheetWeb’s Script Feature.

Step 3: Implementing Payment Links in SpreadsheetWeb

To integrate the payment system into SpreadsheetWeb without requiring any backend development, follow these steps:

Storing Payment Links Dynamically in Excel

Instead of hardcoding payment links into the script, we store them dynamically in an Excel table. The structure of the table should look like this:

| Product Name | Payment Link |

| Basic Product | https://buy.stripe.com/test_6oE29G1G494P6SkeV0 |

| Premium Product | https://buy.stripe.com/test_4gw3dK5Wkdl5b8AdQX |

| Gold Product | https://buy.stripe.com/test_9AQ29GgAYbcX4KcdQY |

We then use a lookup formula to retrieve the payment link of the selected product and assign it to a named range (e.g., SelectedPaymentLink).

Configuring the Pay Button in SpreadsheetWeb

Now, we add a Pay button in the User Interface (UI):

- Navigate to the UI Designer in SpreadsheetWeb.

- Add a Button and name it Pay.

- Select the button and go to its Navigation Settings.

- Choose External Page and enable the Dynamic Option.

- Select the named range (SelectedPaymentLink) as the URL source.

This setup ensures that when the user clicks the Pay button, they are redirected to the Stripe payment page for the selected product.

Why This No-Code Approach Works:

✅ No backend coding required: Everything is handled within SpreadsheetWeb using formulas and UI configurations.

✅ Scalable and flexible: New products can be added simply by updating the Excel table.

✅ User-friendly experience: The checkbox script ensures only one selection at a time.

✅ Seamless integration: Payment links are dynamically assigned and used in the navigation settings.

With this setup, businesses can implement a fully functional, no-code payment system using SpreadsheetWeb and Stripe Payment Links.

Comparing Payment Methods in Detail

There are multiple ways to integrate payments into a SpreadsheetWeb application. In this article, we demonstrated the simplest, no-code approach, where the entire process was configured using SpreadsheetWeb, and Stripe. This method requires no custom development, making it easy to set up and manage.

However, the main limitation of this approach is that the payment status—whether successful or failed—cannot be directly linked back to SpreadsheetWeb. Instead, payment details must be tracked through the Stripe dashboard, requiring the administrator to manually monitor transactions and process purchases accordingly. While this method simplifies integration, it may not be ideal for businesses requiring automated payment validation within their application.

This method is also known as "Stripe Payment Links." To further automate the process, you can use either "Stripe Checkout Sessions" or a "Custom Payment Gateway." However, both of these approaches require backend coding, as outlined in the table below.

| Feature | Stripe Payment Links | Stripe Checkout Sessions | Custom Payment Gateway |

| Backend Required | ❌ No | ✅ Yes | ✅ Yes |

| Customer Tracking | ❌ No | ✅ Yes | ✅ Yes |

| Metadata Storage | ❌ Limited | ✅ Full customization | ✅ Full customization |

| Recurring Payments | ❌ No | ✅ Yes | ✅ Yes |

| Customizable Checkout | ❌ Basic | ✅ Advanced | ✅ Fully Customizable |

| Security & Compliance | ✅ Stripe-hosted security | ✅ Enhanced Stripe compliance | ✅ PCI-DSS compliance required |

Detailed Explanation of the Differences:

- Stripe Payment Links are ideal for businesses that want to process payments without backend development. They work well for simple, one-time transactions but lack advanced tracking features.

- Stripe Checkout Sessions provide enhanced customization and allow for pre-filled customer data, but they require backend integration.

- Custom Payment Gateways offer the highest level of flexibility, allowing businesses to control every aspect of the payment process. However, they require significant development resources and compliance efforts.

For small to medium businesses looking for an easy-to-implement payment system, Stripe Payment Links is the best choice. For larger businesses requiring detailed tracking and more customization, Checkout Sessions or Custom Payment Gateways may be a better option.

Conclusion

Integrating Stripe Payments with SpreadsheetWeb allows businesses to set up an automated, scalable, and secure payment system without the need for a backend server. This approach is ideal for companies looking for a simple and efficient way to manage transactions while maintaining accurate customer tracking.

For businesses requiring advanced tracking and metadata storage, Stripe Checkout Sessions provide a more robust alternative. On the other hand, custom payment gateways offer maximum flexibility but require significant development effort. Ultimately, the combination of SpreadsheetWeb, and Stripe creates a versatile and adaptable payment integration that caters to various business needs. Also check Stripe documentation page for further help.