Introduction

Businesses today require seamless and efficient payment processing solutions tailored to their needs. With the rise of automation tools, it has become easier to integrate dynamic data sources with payment gateways. SpreadsheetWeb, a powerful platform for turning Excel models into web applications, allows businesses to create forms and databases without complex coding. When combined with Stripe, one of the most widely used online payment solutions, users can generate custom checkout session payment links dynamically. The key to this integration lies in Make.com, which acts as an automation hub connecting SpreadsheetWeb and Stripe.

In this article, we will explore how to set up a SpreadsheetWeb application, configure Make.com to process new customer records, and use Stripe’s API to generate a checkout session for payments. We will also discuss the benefits of this approach and how businesses can leverage automation to streamline their payment processes.

Why Use SpreadsheetWeb, Stripe, and Make.com Together For Checkout Sessions?

Manually managing customer payments is time-consuming and prone to errors. By using SpreadsheetWeb, businesses can structure their pricing models dynamically, Make.com ensures seamless data flow, and Stripe provides a robust and secure payment gateway. Here are some key benefits of this approach:

- Automation Reduces Manual Work: Make.com allows businesses to eliminate manual interventions, ensuring that customer details and payments are processed in real-time.

- Personalized Checkout Experience: Instead of using a generic pricing page, customers get unique checkout links based on their selections in SpreadsheetWeb.

- Efficient Customer Management: The integration checks whether a customer already exists in Stripe, preventing duplicate accounts and centralizing transactions.

- Secure and Scalable Payments: Stripe’s compliance with PCI standards ensures secure transactions while allowing businesses to scale easily.

- Flexibility for Custom Business Models: Whether you sell subscriptions, one-time products, or dynamic service packages, this integration supports multiple use cases.

Now, let’s break down the entire setup step by step.

Step 1: Creating a SpreadsheetWeb Application

To begin, we need to create a SpreadsheetWeb application that will serve as our data collection form. This form should include the necessary fields required to process payments dynamically.

Setting Up the Application

- Log in to SpreadsheetWeb and create a new application.

- Design a form with essential input fields such as:

- Customer Name

- Email Address

- Phone Number

- Shipping Address (if required)

- Product Selection Table (allowing users to select products and quantities dynamically)

- Define named ranges for the selected products and total cost.

- Configure a database to store form submissions for later use.

- Add a Save Button in the User Interface section to ensure records are saved.

By structuring the data collection process in SpreadsheetWeb, we ensure that every customer transaction is dynamically recorded and processed.

Step 2: Automating Data Flow with Make.com For Checkout Sessions?

Once the SpreadsheetWeb application is ready, we need to set up Make.com to watch for new entries and process them in Stripe.

Triggering Data Collection

- Open Make.com and create a new scenario.

- Select SpreadsheetWeb - Watch New Data Record as the trigger module.

- Connect your SpreadsheetWeb account and select the application and database created in Step 1.

- Configure the trigger to watch for new records whenever a user submits data.

This ensures that every new customer submission automatically flows into the automation pipeline.

Step 3: Checking for Existing Customers in Stripe

Before creating a checkout session, we must determine if the customer already exists in Stripe. This prevents redundant customer profiles and centralizes all payment history under a single account.

Customer Lookup in Stripe

- Add the Stripe - Search Customer module in Make.com.

- Use the email address from the SpreadsheetWeb record or Customer ID from the “Search Customer” module as the search query.

- Configure a Router with two branches:

This conditional logic ensures that returning customers don’t get duplicate accounts, simplifying transaction management.

Step 4: Creating a New Customer in Stripe (If Necessary)

If no matching customer is found, we need to create a new one.

- Add Stripe - Create Customer module.

- Map the following fields from SpreadsheetWeb:

- Name

- Phone Number

- Address (if applicable)

- Store the Customer ID for the next step.

This step guarantees that every new user is properly added to Stripe’s database.

Step 5: Generating a Custom Checkout Session in Stripe

Now that we have the customer details, it’s time to create a checkout session.

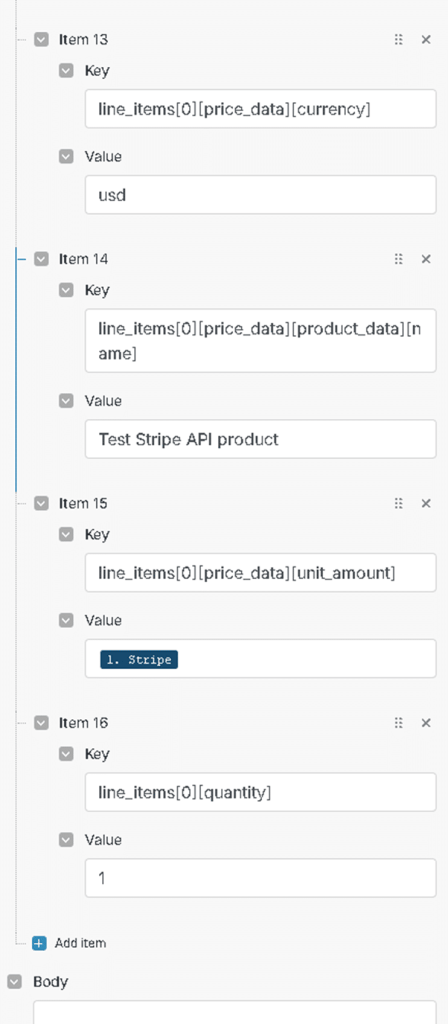

Configuring the API Call

- Add Stripe - Make an API Call module.

- Set the Endpoint URL as /v1/checkout/sessions.

- Choose POST as the HTTP method.

- Include the required parameters:

- success_url: The URL to redirect after a successful payment.

- cancel_url: The URL to redirect if the user cancels.

- mode: Set to payment.

- customer: Map the Customer ID from the previous step.

- line_items[0][price_data][currency]: Use "usd" (or any preferred currency).

- line_items[0][price_data][unit_amount]: Map the product price from SpreadsheetWeb (ensure values are multiplied by 100 for correct Stripe processing).

Step 6: Sending the Custom Checkout Session Payment Link to the Customer

Once Stripe generates the checkout session URL, we send it to the customer via email.

- Extract the checkout session URL from the Stripe API response.

- Use the Email module in Make.com to send an email.

- Configure the email body to include the checkout link and transaction details.

This automation ensures that every customer receives a personalized payment link without manual intervention.

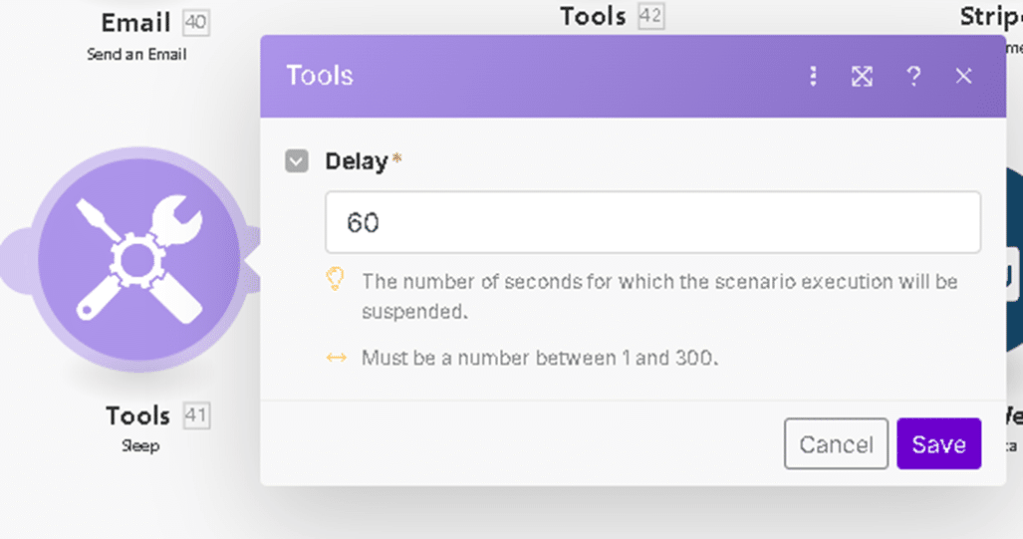

Step 7: Adding a Delay for Payment Processing

After sending the email with the checkout link, we introduce a short waiting period to allow the customer time to complete the payment.

- Add Make.com’s Sleep Module.

- Set the delay time to anywhere between 1 to 300 seconds, depending on business needs.

- This ensures that Stripe has enough time to process the transaction before we check its status.

Step 8: Retrieving Payment Status from Stripe

Once the delay period is over, we check whether the customer completed the payment.

- Add Stripe - Retrieve Payment Intent Details module.

- Map the Payment ID from the API Call module that created the checkout session.

- Fetch the payment status, which can be succeeded, pending, or failed.

Step 9: Updating Payment Status in SpreadsheetWeb

To store the payment result, we update the original record in SpreadsheetWeb.

- Add SpreadsheetWeb - Update Data module.

- Select the same database and application used in Step 1.

- Map the payment status to an appropriate named range.

- This allows businesses to track transactions directly from their SpreadsheetWeb dashboard.

Conclusion

By integrating SpreadsheetWeb, Make.com, and Stripe, businesses can streamline payment collection, reduce manual work, and improve customer experience. This approach offers scalability, automation, and efficiency while ensuring that payments are securely processed.

If you’re looking for an automated, no-code payment processing solution, this method is an excellent choice. Ready to get started? Sign up for SpreadsheetWeb and start building your custom payment workflows today!

For details, please visit also Stripe API documentation page, and Make.com email help page.