Welcome to our guide on Excel RATE function. This function is a valuable tool for calculating loan interest rates, especially when dealing with constant payments and interest rates. In this article, we will provide you with a step-by-step guide on how to use the RATE function, along with essential tips and error-handling methods to ensure accuracy.

The RATE function is particularly useful for financial calculations, especially in the context of annuities. It helps determine the interest rate per period, which is crucial for informed financial decision-making. However, it's important to understand that the RATE function operates through an iterative process and may yield varying results, including zero or multiple solutions. In instances where the successive results of the RATE function fail to converge within a very close margin of 0.0000001 after 20 iterations, the function will return the #NUM! error value.

As we proceed in this article, we will explore how to effectively utilize the RATE function, shedding light on its practical applications and providing guidance on addressing potential challenges. Whether you are a financial analyst, a business professional, or someone seeking to manage loans and investments more efficiently in Excel, mastering the RATE function is a valuable skill that can significantly enhance your financial decision-making capabilities. Let's embark on this journey of financial calculation together.

Supported versions of the Excel RATE Function

- All Excel versions

Excel RATE Function Syntax

| nper | The total number of payments for the loan. |

| pmt | The constant payment amount. |

| pv | The present value, or total value of all loan payments today. |

| [fv] | Optional. The future value, or cash balance you want after the last payment is made. Default value is 0 (zero). |

| [type] |

Optional. When payments are due. 0 = end of period. (Default) 1 = beginning of period. |

| [guess] | Optional. Your guess on the rate, can be a value between 0 and 1. The default is 10%. |

Examples of Excel RATE Function

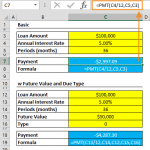

Example 1: Calculate Interest Rate without Future Value and Due Date Type

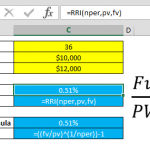

The RATE function in Excel necessitates three essential arguments for its operation: namely, 'nper,' 'pmt,' and 'pv.' These three crucial components allow you to perform a precise calculation of the payment rate over the course of a loan's duration. It's important to note that the function's default assumption is that payments are made at the end of each period, and the objective is to pay off the loan in its entirety.

To illustrate this concept with practicality, let's consider an example. By leveraging these arguments, you can effectively determine the annual interest rate for a loan amounting to $100,000, with a repayment period spanning 36 months and a consistent payment of $3,000 per month.

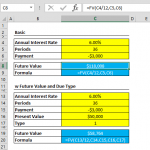

Example 2: Calculate Interest Rate with Future Value and Due Date Type

In addition to the fundamental parameters of 'nper,' 'pmt,' and 'pv,' the versatility of the RATE function in Excel allows you to introduce further refinements into your financial calculations. You have the capability to specify a target cash balance to be achieved after the final payment has been made, as well as the option to decide whether payments should occur at the outset or the conclusion of each payment period.

Consider an extended example, which builds upon our initial illustration. This time, the objective remains the same - to calculate the payment rate, duration, and interest for a loan. However, there are distinctive variations in this scenario. First and foremost, there is a specific target cash balance of $5,000 that needs to be maintained once the last payment is completed. This added dimension can be crucial in situations where you need to ensure a certain financial cushion remains intact. Moreover, another key variation is the timing of the payments. In contrast to the previous example where payments were made at the end of each period, this extended version incorporates payments made at the beginning of each period. This subtle shift in payment timing can have a significant impact on the overall financial dynamics of the loan, including the interest calculation and the payment duration.

By presenting this extended example, we aim to showcase the flexibility and practicality of Excel's RATE function. It not only equips you to determine basic loan parameters but also empowers you to account for nuanced financial scenarios, such as maintaining specific cash balances and altering payment timings. This level of precision and adaptability makes the RATE function a valuable tool for individuals and professionals alike, enabling them to make well-informed financial decisions in a wide range of financial situations.

Error Handling in RATE Function

The RATE function in Excel is used to calculate the interest rate per period of an annuity. However, like many financial functions in Excel, it can sometimes return errors due to various reasons.

#NUM! Error: If the arguments provided to the RATE function are not financially feasible or logically consistent, Excel cannot compute the rate. For example, a negative number of periods (nper) or a combination of values that doesn't make sense financially can trigger this error. Convergence Issues may also lead to #NUM! error. The RATE function uses iterative methods to find the interest rate. If it fails to converge to a result within a certain number of iterations, Excel will return a #NUM! error. This often happens if the provided guess is far from the actual rate, or if the function's algorithm struggles to find a solution due to the nature of the inputs. Exceptionally high or low input values for payments, present value, or future value can cause numerical instability in the calculation, resulting in a #NUM! error.

#VALUE! Error: The RATE function expects all its arguments to be numeric. If any argument is non-numeric (like text or a cell reference that contains text), Excel will return a #VALUE! error. Sometimes, the cell references provided as arguments might point to cells with non-numeric values or errors, leading to a #VALUE! error. Numbers formatted as text, either due to manual input or as a result of a previous calculation, can also cause this error.

To prevent these errors, ensure all input values are within a reasonable and feasible range. This includes checking for positive numbers where required and ensuring that the number of periods, payment, present value, and future value are consistent with each other.

RATE Function Tips

- The RATE function within Excel employs an iterative approach to compute interest rates in diverse financial scenarios. It's important to acknowledge that these iterative calculations can yield zero or even multiple potential solutions, adding to the complexity of financial analysis. To ensure the precision of these computations, the RATE function diligently examines whether the results converge to an astonishingly fine degree of accuracy, specifically within 0.0000001, after executing a maximum of 20 iterations.

- One fundamental rule to bear in mind when utilizing the RATE function pertains to the alignment of 'pv' (present value) and 'pmt' (payment) arguments. If 'pv' is input as a positive value, 'pmt' should be entered as a negative figure, or vice versa. This particularity arises from the nature of financial transactions, where it is crucial to distinguish between funds being disbursed or received. By maintaining this correspondence, you effectively represent whether money is "coming out of pocket" or "going into pocket."

- Furthermore, for added versatility in financial analysis, consider the scenario where 'nper' (number of periods) is initially provided in months, but your goal is to determine the annual interest rate. In this case, a simple multiplication of the RATE function's return value by 12 will provide you with the annualized rate. This conversion streamlines calculations when dealing with loans or investments spanning various time units.

- Should the RATE function encounter challenges in reaching a conclusive result or if the outcome does not align with your expectations, it's valuable to leverage the optional '[guess]' argument. Instead of relying solely on the default 10% guess, this parameter empowers you to experiment with different values, enhancing your ability to fine-tune your financial analysis in complex scenarios.

- Moreover, precision in maintaining consistent units is paramount when working with the '[guess]' and 'nper' arguments. Consider the example of monthly payments on a 5-year loan with a 6% annual interest rate. In this context, entering '6%/12' for the '[guess]' argument, reflecting the monthly interest rate, and '5*12' for 'nper,' representing the total number of months in the loan term, ensures that your RATE function calculations seamlessly align with your intended financial context.

- Other related financial functions:

By grasping these nuances and adhering to best practices, you can harness the full potential of Excel's RATE function, enabling you to conduct precise and insightful financial analysis across a diverse spectrum of financial scenarios, from loans and investments to complex financial models.