Future Value as a Concept

Future value (FV) is a finance concept that calculates how much an investment or a sum of money will be worth at a specific time in the future, considering interest or returns. It uses the principle of compound interest, where the interest adds up over time, increasing the original amount.

To figure out the future value, you consider:

- Initial Amount (PV): This is the starting money or investment.

- Interest Rate (r): This rate shows how the investment grows over each time period.

- Number of Time Periods (n): This is how long the investment will grow.

- Payments (PMT): If you're adding a fixed amount regularly to your investment, this is that amount.

- How Often Interest is Compounded: This could be yearly, every six months, monthly, etc., and it affects how often the interest is added to the original amount.

The basic formula for future value is:

For investments with regular additions, the formula includes these extra amounts.

The FV function in Excel is a key financial tool for calculating the future value of investments or loans. It considers fixed payments and interest rates. This guide will explain how to use this function effectively and address common errors.

Supported versions

- All Excel versions

Excel FV Function Syntax

The syntax for the FV function in Excel is straightforward yet powerful in its financial calculations. It's structured as follows:

In this formula:

- rate refers to the interest rate per period.

- nper is the total number of payment periods in the investment.

- pmt represents the payment made each period; it remains constant throughout the investment's life.

- [pv] (optional) stands for the present value, or the total amount that a series of future payments is worth now.

- [type] (optional) denotes when payments are due. 0 indicates the end of the period, and 1 indicates the beginning.

This structure of the future value excel function allows you to perform complex future value calculations with ease, making it an indispensable tool in Excel for financial analysis and planning.

Examples of FV Function

Example 1: Without Present Value and Due Date Type

The Excel FV function requires three essential arguments: `rate`, `nper`, and `pmt`. These enable you to determine the future value of a loan with consistent payments. By default, the function assumes that payments are made at each period's end, with the goal of fully repaying the loan by the final period.

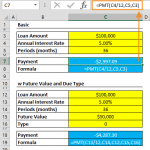

For instance, consider calculating the future value of a loan with monthly payments of $3,000 across 36 months at an annual interest rate of 6%. The formula in Excel would be:

It's important to note that the 6% interest rate is divided by 12 in the formula. This adjustment is necessary because the interest rate is annual, but the payments are monthly. This division ensures the rate is correctly applied per period, providing an accurate future value calculation with the Excel future value function.

Example 2: With Present Value and Due Date Type

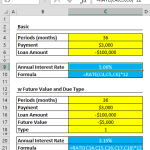

In the FV function Excel, you can also incorporate the present value and specify the timing of payments. This adds depth to your future value calculations, allowing for more tailored financial planning.

The extended formula:

builds upon the previous example. It still calculates the future value based on the same period and interest rate, but with two additional factors:

- A present value (`pv`) of $50,000, indicating an initial amount already paid towards the loan.

- The `type` argument set to 1, meaning payments are made at the start of each period.

By integrating these elements, the "future value Excel" function now calculates the future value considering an existing balance and adjusts for payments made at the beginning of each period, offering a more comprehensive financial analysis.

Tips

When using the Excel FV Function, it's important to understand how the function interprets the sign of the payment (`PMT`) amount. If `PMT` is input as a positive number, Excel considers it as an outflow (money paid out), and thus, the resulting future value is displayed as a negative number. This reflects the reality that the money is being spent or "coming out of pocket."

If you prefer to see this value as a positive number, simply multiply the entire formula by '-1'. This adjustment will flip the sign, making it easier to interpret in certain financial contexts.

Additionally, Excel offers other related financial functions that can be useful in comprehensive financial analysis:

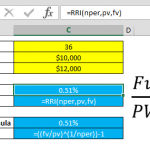

- PMT: Used to calculate the payment for a loan based on constant payments and a constant interest rate.

- NPER: Determines the number of periods for an investment based on periodic, constant payments and a constant interest rate.

- PV: Calculates the present value of an investment; the total amount that a series of future payments is worth now.

Together with Excel future value, these functions form a powerful suite of tools for detailed financial planning and analysis in Excel.