Understanding the application and importance of Monte Carlo simulation in various business scenarios is crucial for any serious organization that relies on numerical analysis for decision-making. The simulation stands out as a powerful and famous method for creating mathematical models that simulate systematic probabilities, thereby providing a reliable approach to understanding complex, uncertain scenarios.

Foundation of Monte Carlo Simulation

The principle behind Monte Carlo simulation lies in its ability to use randomness to solve problems that may be deterministic in nature. Aristotle's observation, “The probable is what usually happens,” encapsulates the essence of Monte Carlo simulation. It uses probability to predict outcomes in a range of situations, from finance to logistics.

Initially developed for assessing the outcomes of card games, the simulation, named after the renowned Monte Carlo Casino in Monaco, has evolved significantly. Karl Pearson's statement, “The record of a month’s roulette playing at Monte Carlo can afford us material for discussing the foundations of knowledge,” reflects its early association with gambling and chance events.

Mechanics

In Monte Carlo simulation, random values for inputs within defined constraints are generated. The results of these inputs are then recorded over numerous iterations. This process creates a large pool of data, consisting of various random input combinations. Each iteration of the simulation offers a unique outcome, contributing to a comprehensive set of data.

The power of Monte Carlo simulation lies in its iterative process. With each iteration, the accuracy of the results improves, offering a clearer picture of the probable outcomes. This iterative nature allows Monte Carlo simulation to provide insights into different data characteristics, such as identifying potential risk factors or scheduling issues.

Applications Across Fields

Monte Carlo simulations are widely used in multiple sectors, including logistics, finance, and project scheduling. Its application extends beyond these areas into fields like meteorology, astronomy, and particle physics, demonstrating its versatility.

Monte Carlo Simulation in Excel

Professionals often prefer to use Microsoft Excel for Monte Carlo simulation. Excel's convenience, combined with its robust feature set and the ease of creating logical models using formulas rather than coding, makes it an ideal platform for Monte Carlo simulation. Utilizing Excel leverages the existing skill sets of employees, making it a preferred choice for running complex calculations.

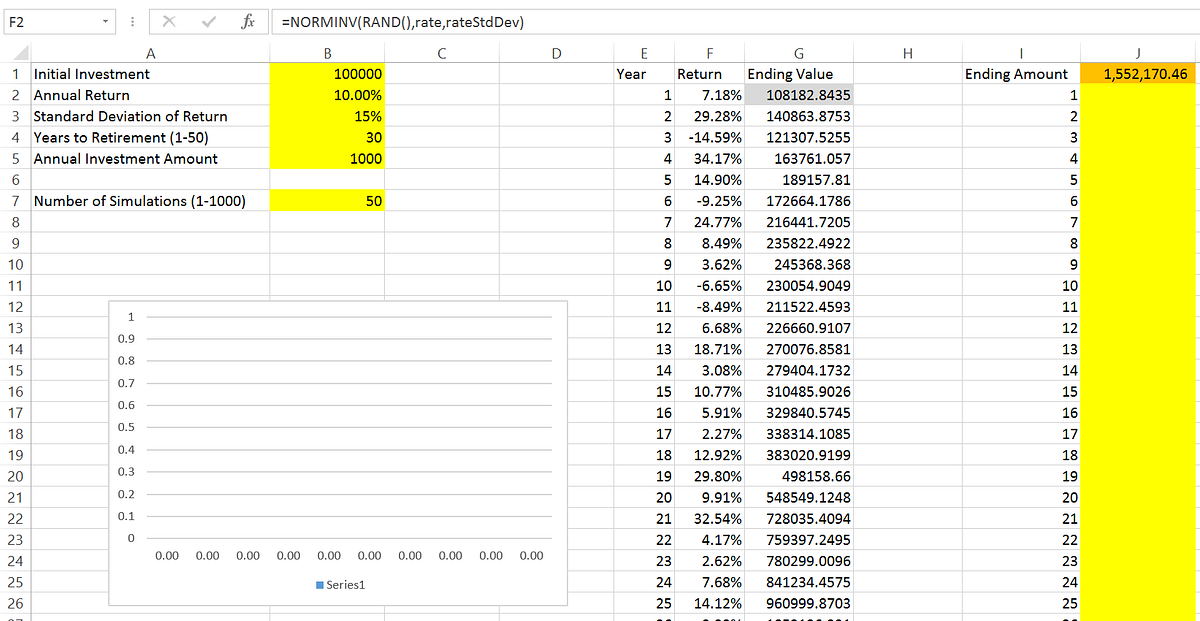

Practical Demonstration in Excel

To see Monte Carlo simulation in action, consider an investment model created in Microsoft Excel. Using this as an example, we can demonstrate the concept of Monte Carlo simulation and show how to implement these complex models effectively. The process involves setting up a scenario in Excel where various investment outcomes are simulated based on random inputs. This simulation can provide valuable insights into the likely performance of the investment under different market conditions.

Monte Carlo simulation is a critical tool for businesses looking to make informed decisions based on numerical analysis. Its application in Excel makes it accessible to a wide range of professionals, enabling them to simulate and understand complex processes and make predictions with greater confidence. As the global business landscape becomes more intricate and data-driven, the role of Monte Carlo simulation in strategic planning and decision-making continues to grow.

Analyzing the standard deviation, median, and specific percentile aggregations of the results can provide crucial insights into the accuracy of the simulation outcomes. This method, which was historically used for solving complex neutron diffusion problems, has now found applications in virtually every field imaginable. Life, with its inherent uncertainties and probabilities, becomes a rich ground for analysis through this simulation method, underscoring the importance of considering all possible scenarios in analytical work.

The Excel RAND function plays a pivotal role in Monte Carlo simulations, primarily because it generates random values, which are fundamental to the simulation's effectiveness. RAND function in Excel is a simple yet powerful tool that creates a random number between 0 and 1 every time a worksheet is recalculated or the function is called. This random generation is crucial for simulating the randomness inherent in real-world scenarios.

In a Monte Carlo simulation, the RAND function's output forms the basis for generating a series of randomized values within a specified range. This is achieved by defining a range for these random values, which then can be applied across multiple iterations or scenarios in the model. This process is key to simulating a wide array of possible outcomes based on different sets of random inputs.

For more complex Monte Carlo applications, these randomized values generated by the RAND function are not used in isolation. Instead, they are often integrated into a series of complex formulas. This integration is crucial as it allows the random values to influence different variables in the model, thus reflecting a more accurate and varied simulation of real-world conditions. This versatility and integration capability of the RAND function, when combined with Excel's computational power and formula flexibility, make Excel an ideal platform for creating and running Monte Carlo simulation models. Excel allows for the creation of dynamic and complex models that can replicate a wide range of probabilistic scenarios, making it a powerful tool for risk analysis, financial forecasting, project management, and other areas where uncertainty and variability play a significant role.

The RAND function's ability to generate random numbers seamlessly integrates with Excel's broader capabilities, making it an essential component for conducting Monte Carlo simulations in various professional contexts. This combination allows for the creation of robust, adaptable, and comprehensive models that can provide valuable insights in decision-making processes. Consider, for instance, a model designed to estimate retirement investments using Monte Carlo simulation. While Excel’s capabilities in handling such models are extensive, there are inherent limitations and risks involved. One primary concern is the security and control of the spreadsheet. When distributed externally, there's a risk of intellectual property theft, and internally, ensuring that all users are working on the most current version of the document poses a challenge. Distribution of documents often falls short in ensuring process continuity and future-proofing.

Monte Carlo models, particularly those of high complexity, can be resource-intensive and may require significant computational time, sometimes extending over days or weeks. While Excel is robust, it is fundamentally limited by the hardware capabilities of desktop PCs, and running these simulations on mobile devices is generally impractical.

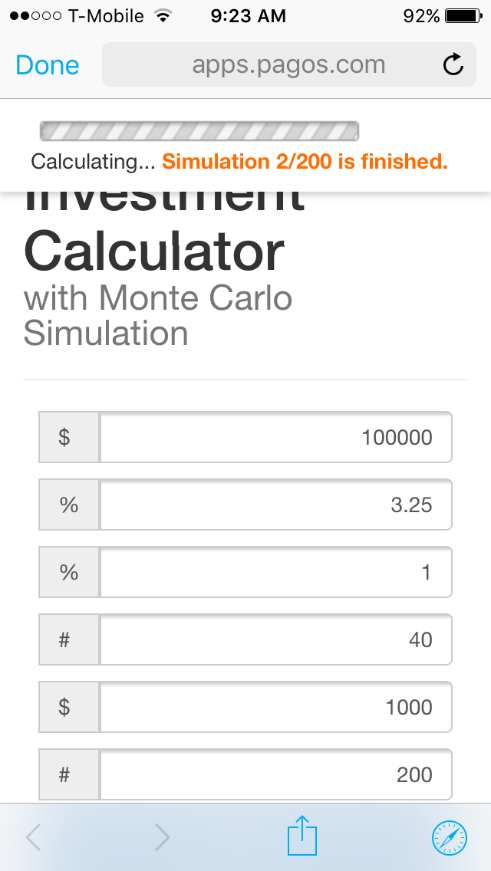

An innovative solution to these challenges lies in transitioning the data and calculation logic to a web-based platform. Tools like SpreadsheetWEB offer a pathway to leverage the flexibility and functionality of Excel while mitigating its vulnerabilities and technical limitations. By moving the model to a web application, users benefit from enhanced processing power and storage capabilities provided by server-based solutions.

An example of this would be a web application optimized for all platforms, capable of running hundreds of iterations with given inputs, accessible even from mobile devices. This approach not only retains the analytical power of Excel’s Monte Carlo simulation but also extends its accessibility and security, making it a more robust and scalable solution for complex data analysis.

Monte Carlo simulation, when combined with the power of web-based platforms, opens up new avenues for data analysis and decision-making, harnessing the potential of cloud computing while retaining the familiar interface and capabilities of Excel.

Below is our web application running 200 iterations with the given inputs. This application was optimized for all platforms, and can also be accessed from mobile.

The Monte Carlo simulation approach establishes a range of potential outcomes and maps the frequency of each value's occurrence in the form of a chart. By examining this distribution chart, you can identify the most probable outcome. Additionally, this method allows for the visualization of various other outcomes and highlights specific areas of risk.

Upon inputting data, the Monte Carlo method generates various random solutions, offering a quick view of multiple potential scenarios. This statistical analysis approach is highly regarded for its reliability in decision-making, with many savvy businesses incorporating it into their strategic processes. For most professionals, creating complex models like these in Excel is typically straightforward, leveraging Excel's robust capabilities.

However, having your model in Excel format won’t allow for any scalability, nor will it help for keeping your intellectual property safe and accessible. Converting statistical models created in Microsoft Excel, into web applications allow for larger scale automation and extensive security options.

Solving probabilistic models is already a huge challenge. You don’t need any more headaches caused by versions or employing coders, you can do all of this by yourself with SpreadsheetWEB! Add a little web design knowledge, and your web applications can become full-scale, stand-alone projects.

Repost from Medium