Unlocking the full potential of Excel often involves mastering its powerful functions for financial calculations. One such indispensable tool is the Net Present Value (NPV) function, a crucial component in financial analysis. In this comprehensive guide, we will delve into the intricacies of using the NPV function in Excel. Whether you are a seasoned finance professional or someone venturing into the realm of financial modeling, understanding the nuances of NPV can significantly enhance your analytical capabilities. Join us on this journey as we explore the syntax, examples, and practical tips for leveraging the Excel NPV function to make informed financial decisions.

Supported versions

- All Excel versions

Excel NPV Function Syntax

Arguments

| rate | Discount rate over one period. |

| value1 | The first value of cash flows. A range can be used to refer 1 to 254 arguments representing the payments and income. |

| [value2],… | Optional. The second value of cash flows. This can be omitted by using a range for value1. |

Examples

We are going to be using named ranges in our examples to make the formulas easier to read, but this is not required.

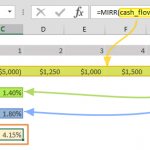

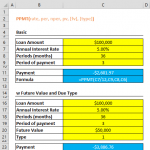

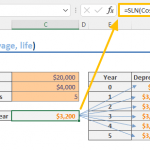

Example 1

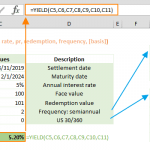

Example 2

Tips

- The Excel NPV function uses the order of value1, value2, ... when calculating the outcome. Therefore, you must pay attention to the order that you enter the payment and income values.

- Arguments that are empty cells, logical values, text representations of numbers, error values, or a text string that cannot be translated into numbers will be ignored.

- If an argument is an array or reference, only numbers in that array or reference will be counted. Empty cells, logical values, text, or error values in the array or reference are omitted.

- If you have the exact dates of cash flows, and need to be very precise with your calculations, use XNPV instead of the NPV function.

Mastering the NPV function in Excel opens up a world of possibilities for financial modeling and decision-making. This guide has equipped you with the essential knowledge to utilize the NPV function effectively, from understanding its syntax to exploring practical examples. As you navigate through Excel workbooks, incorporating NPV into your financial toolkit empowers you to assess the present value of future cash flows with precision. Remember the tips provided, ensuring the correct order of arguments and handling empty cells, logical values, or text representations. Whether you are analyzing investments, evaluating project viability, or making strategic financial decisions, the Excel NPV function is a key ally in your journey toward financial excellence.